People know that mortgage rates are at all-time lows. What people don’t know is how long it will last.

People know that mortgage rates are at all-time lows. What people don’t know is how long it will last.

There is going to be a time (perhaps sooner than some think) when bond yields run up and take fixed mortgage rates with them. This inevitably will be followed by throngs of homeowners rushing to lock in their mortgages.

Few can tell in advance when that time will come. The only way most people can time the market is with hindsight—when it’s clear by looking at a chart that rates have bottomed.

If you wait until then, however, you’ll probably miss the lowest fixed rates by 1/4% to 1/2% or more. So what do you do?

Assuming you don’t have a discounted variable rate, like prime – 0.50% (those are keepers), one option is to take a good fixed-rate deal when you can get it.

People already in a variable or 1-year convertible mortgage can lock in at tremendous rates today. Typical conversion rates are roughly 3.95%-4.15% at the moment. Compare that to posted fixed rates over the last 58 years (illustrated in this chart above). 4% is pretty darn good. If bond yields bolt above 2.00%-2.15% (they closed at 1.97% Friday) no one can be faulted for locking in at today’s low rates.

People already in a variable or 1-year convertible mortgage can lock in at tremendous rates today. Typical conversion rates are roughly 3.95%-4.15% at the moment. Compare that to posted fixed rates over the last 58 years (illustrated in this chart above). 4% is pretty darn good. If bond yields bolt above 2.00%-2.15% (they closed at 1.97% Friday) no one can be faulted for locking in at today’s low rates.

There are also some amazing bargains out there for purchases, switches, and refinances. One non-bank lender, Merix Financial, launched a new 5-year fixed promotion on Wednesday. This mortgage has all the bells and whistles–20% prepayment options, portability, skip-a-payment, etc.–for a historically low rate of 3.69%. That’s only 0.39% to 0.44% above most variable rates. [This mortgage must close by May 29, 2009. No pre-approvals.]

No-frills fixed-rate mortgages–with only 5% pre-payment privileges–are also available at slightly better rates (but only in certain provinces).

Of course, if you’re shopping for a new mortgage you will come across alternatives to a 5-year fixed. Some people are still advocating:

- Variable-rate mortgages (Variables have had a long-term statistical edge, but today’s environment is different. Most current variable-rate proponents are people trying to squeeze every last basis point out of the market. They tell you to lock in when the time is “right,” but they rarely tell you when that is. If you’re going this route, good luck with both your timing and your rate conversion.)

- 1-year convertible/fixed mortgages (Same story as with variables.)

- 2-4 year fixed mortgages (While attractive last week, this week’s 3.69% 5-year option has reduced the allure of these terms–unless you plan to pay off your mortgage before five years, or plan to close after May 29.)

In general, the current alternatives are not overly compelling; however, exceptions do apply. Speak with a mortgage professional about your specific situation.

From a macro economic standpoint there are additional reasons to consider a long-term rate lock:

- The Bank of Canada’s overnight target rate is down to 0.50%. That means there is very little room for bankers' acceptance rates and prime rate to fall further. (Both influence variable mortgage rates.)

- Most economists expect that stimulus-led inflation will push up bond yields (and fixed mortgages rates) well before the economy actually recovers.

- Mortgage spreads have slowly been improving this year. As spreads get tighter lender margins often get smaller. This too may impede further fixed-rate declines.

- Bonds have become heavily overbought because investors have flocked to them for safety. If traders start to value return more than safety, bonds will fall and bond yields will rise.

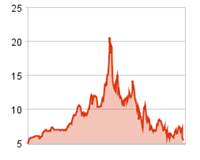

Indeed, yields on the 5-year bond have been somewhat suspect as of late. See the chart on the left (it shows 5-year yields over the last 12 months). Yields have been lingering quietly below the 2% mark for weeks now. They’re seemingly coiled like a spring–ready to leap higher at the first sign of economic strength.

Indeed, yields on the 5-year bond have been somewhat suspect as of late. See the chart on the left (it shows 5-year yields over the last 12 months). Yields have been lingering quietly below the 2% mark for weeks now. They’re seemingly coiled like a spring–ready to leap higher at the first sign of economic strength.

Whatever the case, there is one simple question people should ask themselves: “If bond yields run up from here, is it worth staying in a variable or 1-year mortgage?”

If economists are right, this gamble might save you 0.39% to 0.44% over today’s fixed rates for 6-12 months. If they’re wrong (or you don’t time your rate lock properly), you could conceivably end up paying over 0.50% above today’s low rates…for the the following 4 to 4 1/2 years!

(Chart data courtesy of the Bank of Canada)

___________________________________________________

Update (April 21, 2009):

The Bank of Canada announcement today will undoubtedly affect the rate-lock picture. Their unusual and very public commitment to keep rates low until June 2010 (contingent on inflation) may help depress bond yields further for the short-to-medium term. With yields now well under the key 2.00-2.15% area there is less urgency to consider locking in existing variable-rate mortgages–but keep an eye on that range.

Hello. Love your site, find it very informative. I have a VRM with TD which is prime -.75. Why do you consider discount variables keepers and suggest it might be a good time to lock in with a VRM? We are considering locking in, but the rate we are paying now is just too good to give up.

Hi C.N.

Thanks for the note. It’s a great question. I’ll try to prepare an amortization comparison to illustrate. Check back by late Sunday night.

Cheers,

-Robert

Looking forward to seeing your illustration. I am currently 1 year into a prime -.85 and curious to see the comparison.

I also have found your site very informative and helpful. We bought our first house fall 2006 and got a VRM (prime – .9), but it looks like we’ll be needing to move this year–we have a growing family and running out of space (we rent the basement–ie half the house–to pay the mortgage, and the layout doesn’t allow us to take over a portion, and we can’t afford the pmts without the suite). For a number of reasons, we’re looking for a smaller place without a suite that we can afford, and we’ve seen canidates out there.

So, I’m just looking for some thoughts on our situation–given the mortgage is assumable (to qualified purchasers) and portable, should we be considering either? Since we’re downsizing, I’d assume that porting it to our new property won’t be an option. We’ll be talking to our broker soon, but if anyone has anything they think we should consider or keep in mind, I’d appreciate your thoughts.

Thanks!

CN & SPL,

I ran the following two amortization scenarios based on a $100,000 mortgage and 25-year amortization (for simplicity):

Scenario #1) A new homebuyer choosing a variable mortgage at 3.00% (prime + .50) for six months, and then locking into a fixed at 4.50% (a sample conversion rate assuming rates increase). This is then compared to simply choosing a 3.85% fixed rate from the start.

Outcome: A person would be better off to take the 3.85% fixed from the outset. The benefit of doing so is roughly $2300 over five years.

Scenario #2) An existing mortgagor at 2.00% (prime – .50%), holding that mortgage for the term (i.e not locking in) and incurring 0.25% rate hikes every three months until the Bank of Canada has increased prime 3% from today’s level.

Outcome: The person is better off keeping their prime – .50 variable, by about $200 (or more depending on your remaining term). If one’s discount from prime were bigger, like prime – 0.75%, then the benefit of doing nothing would potentially be magnified.

So those are the comparisons in a nutshell. I’ll try and see if I can get screenshots of my amortization spreadsheets uploaded to this page. In the meantime, if you have specific questions simply email a local mortgage planner, or us if you prefer.

———————————-

Important: These are sample scenarios meant for general information purposes. This is not a recommendation. Retain a licensed mortgage professional before acting on this information.

Very interesting!

Rob, is there any way for homeowners with variables to construct DIY amortization schedules? It’s easy to find them for fixed rates, but I haven’t seen anything that would allow you to enter in rate changes at different times to see their impact.

I imagine you guys have software for it.

I’m sure my lender is getting annoyed with me asking for constant updates on my balance. ;)

I currently have a mortgage at 5.99% and I am thinking of selling my house and building a new one. What would be the best way to go about this given the great rates that are out there?

I’ve been considering the 3.69% fixed from Merix vs 3.90% from BMO (mortgage portion of a readiline mortgage/re-advanceable HELOC). is Merix a secure/dependable lender? Are there risks in dealing with them compared to the big banks? I’ve been trying to research them online but their site is down (seems like a bad sign).

Thanks for your time. I enjoy the site!

I understand that over the long term a variable rate is the way to go. But what if your mortgage is near the end – under 3 years. Is a variable rate still the way to go given today’s uncertain markets (my credit union’s prime is 3%) or should I lock in for 3 years at 3.99% which is very temping.

I have found that they are not keen on negotiating the rates when the outstanding balance is relatively low, but they sure were open to discounting the rate when I owed more. So much for customer loyalty.

I’ve been with the same credit union for 15 years and they do pay out some pretty good patronage payments that make it worth staying with them.

Any advice.

Hi Mark,

I’d like to take the opportunity to jump in and respond. MERIX has been around for just under 4 years now. In that short time we’ve grown to be among the top 10 lenders to the mortgage broker/planner industry. We are strictly Prime “A” lenders. In terms of our size, we have over 26,000 mortgages totalling $7 Billion under management. This past February we issued annual morgage statements to 33,000 Canadian homeowners.

Our pride, however, is in our customer survey results. In our most recent survey, 92% of our existing customers said they would recommend a friend or relative to MERIX.

It is unfortunate you are having difficulties accessing our site. The link below should work:

http://www.merixfinancial.com

If you have any questions about what we offer at MERIX, please speak with your mortgage originator/planner.

Cheers!

Andrew Kuyper

Director, Marketing and Operations

MERIX Financial

Thanks Andrew, and kudos on Merix’s fantastic fixed-rate offer.

“Rob, is there any way for homeowners with variables to construct DIY amortization schedules? It’s easy to find them for fixed rates, but I haven’t seen anything that would allow you to enter in rate changes at different times to see their impact.”

Hi Al,

Hope all’s well. I can’t think of a good amz schedule on the web that lets you enter rate changes at different points in your term. It would definitely be handy though. We have a custom spreadsheet for this purpose and I’ll see if it’s something that can be added to our site.

Cheers,

-rob

Question for you all….

I locked into 10 yr 5.85% rate at PC last June. I was scared into locking and obviously regret it now. As a first time mortgage/home owner, I’m wondering if it’s possible for me to call the bank and decrease my years down to a 5 yr and pay the penalty? Can you decrease the year term? Anyone know what PC’s penalty is off hand? Any personal opinions would be great. Thanks!

aaa–you are sol.

Could you explain? Can I not refinance and pay a penalty?

I should also mention that the mortgage has 89,600 left to pay.

I am considering a VRM or 5 yr FRM. VRM = prime+0.5% (currently 2.75%) and FRM = 3.69%. The difference to my monthly payments would be $320ish if i go the VRM so it looks very attractive. I am concerned though that if rates on fixed start to jump up within the next year or so and i don’t lock in close to the 3.69% rate that all benefit gained from the lower VRM rate will be lost. Any suggestions about which route to go?

I have a discounted variable rate (.5%) mortgage but I noticed that some countries are increasing their prime lending rates. When inflation hits, and it will, will I wish I had a 10 year closed? Or, should I stick with my variable? I have three years left on it.

Brent

Call your broker or bank for a recommendation. You can’t get proper advice just by posting your interest rate and remaining term on a web forum.

Don

my variable rate is 1.6 why should I lock into a 5 years at over 3 percent?

“Rob, is there any way for homeowners with variables to construct DIY amortization schedules? It’s easy to find them for fixed rates, but I haven’t seen anything that would allow you to enter in rate changes at different times to see their impact.”

This is handled well (and free) with http://www.amorty.com

Hello every one…

i need your help here

I am a first time home buyer and i have to go for a Variable of Fixed Rate.

i am new here and i know nothing about the mortgages options

Please help me here

wich one should i go with and why is this better then the other

Thanks alot