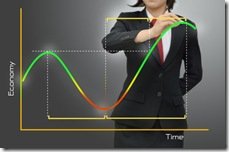

We’re at one of those points in the economic cycle where mortgage rates get especially confusing.

We’re at one of those points in the economic cycle where mortgage rates get especially confusing.

On the one hand, we see the Bank of Canada confirming that it has no plans to raise short-term interest rates for several months (maybe several quarters). And on the other hand, we have bond traders pushing up long-term interest rates to two-year highs.

That’s got many wondering:

a) which side is most reflective of the long-term trend, and

b) how mortgage shoppers should position themselves?

The Gatekeepers of Rates

First off, here’s one basic point to reinforce. Two primary entities control the direction of mortgage rates in this country:

- The Bank of Canada (BoC)

- Whose monetary policies directly impact short-term rates (like variable and 1-year fixed terms)

- The bond market

- Where bond yield movements influence longer-term rates (like 5- and 10-year fixed terms)

What the BoC is Saying

The Bank of Canada sets interest rates based on where it believes inflation is headed 18-24 months from now. Yesterday, the Bank conveyed three key points in that regard:

The Bank of Canada sets interest rates based on where it believes inflation is headed 18-24 months from now. Yesterday, the Bank conveyed three key points in that regard:

- It acknowledged what everyone knows, that “Inflation in Canada remains subdued…” (Inflation control is the BoC’s core mandate, and the overwhelming reason it changes interest rates.)

- As long as inflation remains in check, and there is “significant slack” in the economy, and household debt doesn’t come to a boil, current rates will “remain appropriate.”

- Rate increases, once they finally arrive, will likely be “gradual” and just big enough to keep inflation at the BoC’s 2% inflation target. (Those with memories of the early 80’s can probably safely discard of fears of 300 bps rate hikes in the next few years.)

What the Bond Market is Saying

The bond that everyone in our industry watches is the 5-year “government of Canada” (GoC). Its yield jumped 10 basis points Thursday to 2.16%, a brand new 2-year high.

Traders have been selling bonds and pushing up long-term rates for four reasons, among others*:

- Positive economic momentum continues down south, which many feel could accelerate our GDP and spark inflation concerns

- A reinvigorated Canadian housing market (at least temporarily so)

- Canada’s weakening loonie (which makes holding Canadian bonds less attractive)

- Continued outflows from global bond markets (the multi-decade bond bull market is deflating, at least somewhat)

* Bond prices and yields have an inverse relationship. If one goes up, the other goes down, and vice versa.

What Analysts are Saying

- “The BoC continues to reference language that has us believing they are on hold into 2015”

— Derek Holt, Scotiabank Economics

- “…We are still looking at a very long period of inactivity by the Bank [of Canada], and may well be talking about four years of unchanged rates a year from now”

—Doug Porter, BMO Capital Markets via CBC

- “…This is a central bank that…is happy to sit on the sidelines and wait for substantial proof [that]…(economic) acceleration is underway before raising rates”

—Avery Shenfeld, CIBC World Markets via Calgary Herald

- “(The central bank’s statement) gives us comfort in our view the policy rate will remain where it is for the next 15 to 18 months, even 24 months”

—Terrence Connelly, Contingent Macro Advisors via Montreal Gazette

Most of Canada’s market prognosticators envision the next BoC rate increase in late 2014. That roughly coincides with financial market bets, where OIS traders are pricing in the next hike by September 2014.

In the words of CAAMP economist Will Dunning, however, “…Frankly, forecasting does not work.” Take these projections with a wad of skepticism.

What it Boils Down To

Despite the technical damage currently being done to the bond market, there’s a cold reality in today’s rate environment:

- Economic growth and inflation are significantly underperforming expectations and the BoC isn’t about to raise rates until that situation reverses

- The recent long-term rate increases act as economic brakes, reducing the need for further rate hikes

- All it takes is one global crisis to reverse the upswing in yields (a low probability but still a possibility)

- Absolutely nothing at this point suggests a persistent growth rate much above 2%. So long as GDP is stuck in a ~2% rut, inflation will likely remain at or below that range. With that backdrop, future rate increases could be moderate (e.g. limited to 1-2 percentage points) and/or be short-term in duration.

A well-qualified risk tolerant borrower (e.g. someone with 20%+ equity, great credit, strong provable income, and 10+ years paid down on their mortgage) would do well to consider a short-to-medium term mortgage if the rate savings were big enough compared to 4- and 5-year terms.

A well-qualified risk tolerant borrower (e.g. someone with 20%+ equity, great credit, strong provable income, and 10+ years paid down on their mortgage) would do well to consider a short-to-medium term mortgage if the rate savings were big enough compared to 4- and 5-year terms.

For example, if the best 5-year fixed was 3.59%, and the best 1-year fixed was 2.49%, that’s a spread of 110 basis points. This is enough to absorb 175 basis points of rate increases, spread out over the next 48 months—making the 1-year term a reasonable gamble for sound borrowers.

If your financial circumstances aren’t so robust, 4- and 5-year fixed terms remain at just a stone’s throw (80-basis points or less) from their record lows. Those are rates that people would have begged and stole for back in 2000.

Rob McLister, CMT

Perhaps the biggest issue is how the recent 80+ BPS hike on the 5 year is effectively a 250 BPS hike from a qualification standpoint for most RATIONAL and risk-tolerant borrowers….Why? Because a rational borrower would likely have taken a ~2.89% 5 year fixed just a few months ago…now, in order to qualify for the most rational term (a short or variable rate, as explained in detail above), a borrower must qualify at 5.34%. This will have a impact on affordability for informed and non-impetuous buyers.

I’m not sure this has been felt yet by the housing market or reflected in trailing data, but in my opinion it is significant nuance. It would be very prudent for MoF, OSFI and the BoC to take this factor into account before setting future policy.

Aaron,

You have been mislead by the “Bears” who have fed you false information.

You qualify for the 5 year fixed at the contract rate. So 3.7% it is right now.

The qualification rate for other mortgages went up from 5.14% to 5.35%. NOT a 250 basis point jump. Time to go back to that greaterfool blog.

I fully expect the 5y term to also require a higher qualification rate when OSFI implements their next round of changes. It makes no sense to qualify someone for a 20% greater mortgage just because they picked a slightly longer fixed term as they will also have to deal with higher rates when they renew.

Re-read my comments Tony and for that matter the whole blog post to begin with. I’m saying that the average rational borrower would have taken a fixed rate 4 months ago. Today, he/she will likely want to go variable or short. This means effective qualification rates have risen 250 BPS.

And just because I think that housing may be affected by changes to the price/supply of credit doesn’t make me a doomsayer.

Nuance is the enemy of the obtuse.

I hope you’re wrong but fear you’re right.

In my opinion it actually makes no sense to qualify buyers at rates higher than what they are reasonably forecast to pay. When is the last time a trailing, 5-year average market (not posted) rate was 5.34% or higher? 10+ years ago?

From a regulatory standpoint you could achieve the same thing by gradually lowering TDS/GDS over a decade or longer. This would unwind “excessive” borrowing without causing the market to potentially seize by causing effective rates to soar.

We have 2.19% six month mortgages in Manitoba. I like them best of all because you can lock in your renewal rate just two months after closing.

We have flying ponies here. We like them very much because they can fly.

;) the joke aside, where do you get that rate from in Manitoba ?

If I was to buy a home today to build in a comfortable budget I would use 6% rate and allow any difference from having a lower rate regardless of term to go towards prepayment. Bank of Canada has many charts in historical rates including this one on fixed 5 year mortgages http://www.bankofcanada.ca/wp-content/uploads/2010/09/selected_historical_page57_58.pdf

a falling $CDN = higher inflation (since imports cost more)

don’t be so sure we’ll stay below that 2% target

Interesting thought and possiblity.

Not sure what would be gained by requiring a higher qualification rate for long term mortgages though. To do so would suggest that people do not have the option of selling their homes (asset) if their financial situation changes. Nothing could be further from the truth. What percentage of people would be forced to sell is difficult to predict but historically I think the number has been relatively small (does anyone have the actual percentage?) With minor impacts on the market.

All prior changes have been taken to minimize government exposure to a housing market collapse. That suggests that they expected a collapse, and implies that they were not able to prevent such a collapse in the short term.

The only reason I can see for the government to implement such a rule change now is that they foresee a complete collapse in our economy within the next five years forcing the government to cover their obligations promised through CMHC. If they can see a collapse in the long term, they have time to prevent it – or they are completely powerless to prevent it.

Any risk based scenario can be modeled in a computer; that doesn’t mean that it will happen. Changing the qualification rules for 5 year mortgages would be in response to a computer simulation with little probablity of actually happening.

Budgetary comfort is a luxury enjoyed by people who don’t need budgetary comfort. For the rest of us, mortgage payments at 6% interest are not realistic when you have to put food on the table, raise kids and save for retirement.

Cambrian and Crosstown both have 2.19%

http://www.cambrian.mb.ca/Rates.aspx#residential

http://www.crosstowncivic.mb.ca/index.php?option=com_content&view=article&id=86&Itemid=85

I’m not so sure the qualification rate matters to home sales. If people can’t buy with a variable mortgage they will buy with a 5 year fixed. The effect will be on interest paid more than home sales.

Hi Stats,

That’s certainly a fair point to raise. There has often been a correlation between currency depreciation and inflation. Causation, however, isn’t always straightforward.

A few points:

* Inflation is a persistent increase in the general level of prices, which occurs when total economic demand grows faster than total supply. By contrast, currency effects often lead to a one-time or transitory price adjustment.

* Demand for Canadian goods is dictated more by factors like the money supply and economic performance (foreign and domestic) than exchange rates.

* A continued drop in the loonie could very well coincide with weakening demand and/or falling oil prices. Both of those scenarios could be deflationary, thereby offsetting some or all of our lost buying power.

* On that note, our dollar is a petrocurrency so a bet against the loonie tends to be a bet against oil prices.

* Any analysis of currency rates and inflation must also evaluate: (a) the degree of cost pass-through by foreign producers, and (b) the degree of consumer substitution (of domestic goods for higher priced foreign goods).

* And of course, currency movements are often temporary. It can’t be assumed that the loonie will keep falling.

These, among other reasons, are why we don’t usually get into exchange rate analysis in stories like this. But it’s an interesting topic nonetheless.

Cheers…

Would you lock into a 10 year mortgage at 3.64???

In a heartbeat but this rate doesn’t exist anymore, unless you had it locked in a few months ago.

would you lock into a 3.54% 5 year fixed or 5 5 year variable at 2.5%

Would you lock into a 3.59% 5 year fixed

Or would you take a 2.5% variable?

Why choose when you don’t know the right choice? Go half fixed and half variable.

I don’t know what to do?

5 yrs fix for 3.59% or 5 year variable close for 2.7%. Please advise.

Hey Mike…

Sounds like your paying a premium with either choice…3.49% 5yr fixed rates are available with multiple lenders and 2.55 % variables are a standard rate now… push you lender for better rates. Email Rob from this site he has access to great rates and will set you up… He doesn’t solicit business for himself so contact him direct and get some rate quotes he is also a great fiduciary and will be your sounding board and help you find the right fit

Hey Rob,

Sorry if I was out of line with the unsolicited promotion.

Readers… Rob is a great person to have a suitability conversation with and will help you pick the right product if you want his help you have to track him down as he does not solicit clients from this site as which is respectable for us industry readers. Much respect Rob.

Island Advisor

Its been great for all the Canadian mortgages as the U.S. government shutdown has had an interesting side effect for Canada.