Canada’s national housing supply is at the lowest levels seen in 12 years, according to the Canadian Real Estate Association (CREA).

There were just 4.2 months of inventory left across the country at the end of November 2019—the lowest level recorded since the summer of 2007 and far below the long-term average of 5.3 months. This means if sales continue at their current pace, all housing stock will be liquidated in just over 4 months.

“Home prices look set to continue rising in housing markets where sales are recovering amid an ongoing shortage of supply,” said Gregory Klump, CREA’s chief economist. “By the same token, home prices will likely continue trending lower in places where there’s a significant overhang of supply, perpetuated in part by the B-20 mortgage stress test that continues to sideline homebuyers there.”

Sales are going strong with transactions up 11.3% year-over-year. Most Canadian major urban centres in Ontario, British Columbia and the Maritime provinces posted an increase. The Prairies are the only markets suffering from an oversupply of homes, built during oil boom times.

It’s a basic case of supply and demand: if prospective buyers maintain or increase their demand for property and if prospective sellers continue to shrink or sit on their listings, then housing prices will rise.

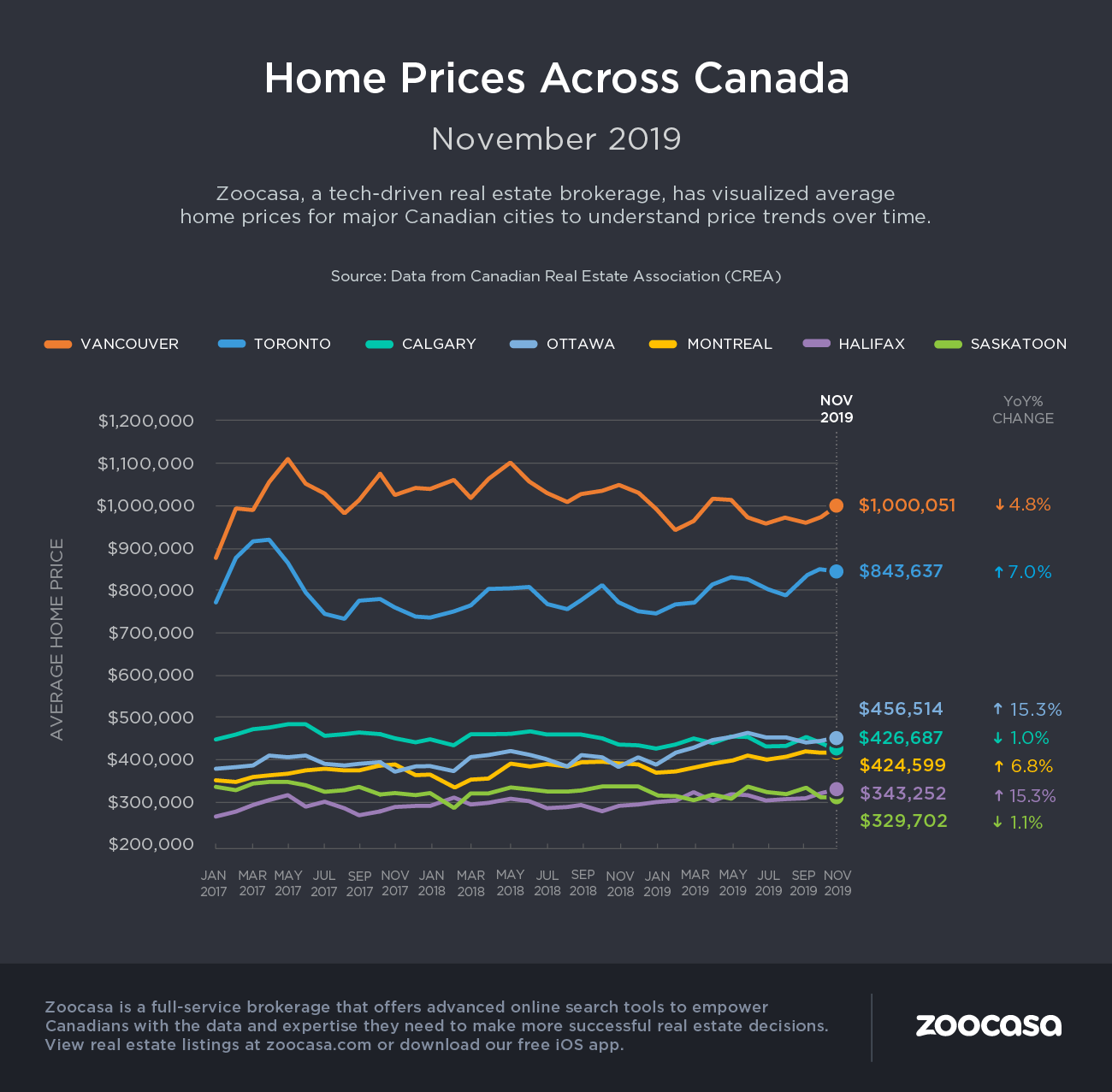

Already we can see that housing prices edged higher this November compared to a year earlier. Benchmark prices in the 19 markets CREA tracks rose 2.6% year-over-year to an aggregate of $638,300. The average price, while a less accurate reflection of the “typical” home, showed a much greater jump, up 8.4% year-over-year to $529,000. Excluding the hyper-priced markets of Toronto and Vancouver cuts almost $125,000 from the national average price to $404,000 and shrinking the year-over-year gain to 6.9%.

Ontario cities are leading the way in price gains, with Ottawa benchmark prices soaring 11.45% to $443,500, the Niagara region up 7.99% to $431,200 and Greater Toronto up 6.52% to $823,700.

Smaller urban centres around the country with less expensive housing are also doing well, with Montreal properties rising 8.72% to $380,000 and Moncton up 4.88% to $190,300. British Columbia is still experiencing a short-term drop in prices from their peak in 2016 and 2017, possibly due to the stress test and vacancy tax, with prices down 4.59% to $1,002,700—the second most expensive area in the country next to Oakville, Ontario, a tony suburb of Toronto. All Prairie cities have declined over the long term, with Regina down 5.52% to $260,600 and Calgary down 2.43% to $414,200.

For more price information on Canada’s housing market this month, check out the infographic below:

Zoocasa is a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View houses for sale and MLS listings at zoocasa.com or download our free iOS app

I can only speak for the escalating house prices in Ontario perhaps, but the fact remains that too many Ontario “house” buyers are not “home” buys as much as they are speculators. Many, maybe too many, don’t purchase a house to settle down in for a long term domicile, a home, but they purchase a house for a short term place to occupy, maybe to just fix a little, paint up, and put it back on the market to sell at a profit, often at a very large profit in an insanely active market like Toronto.

In Ontario at least, if not other Provinces and Territories the profit is not taxable at the house speculator’s tax level but only at a “half tax level”. The tax house speculators pay is called “Capital Gains” tax, provided that the speculator can prove the “house” is his “home” at the time of sale.

The prices of house purchases will continue to escalate in Ontario as long as this “Capital Gains” or what I call “Half Tax” regime exists.

I know. I admit that I am complicit in this scheme. I’ve been there, done that, and collected the T-Shirts.

Stop it Canada! Tax those house speculators like other jurisdictions where purchasers are buying homes to live in and not sell to the highest bidders like stocks on the TSX.