Canada’s big banks announced this week that those struggling due to the COVID-19 crisis will be able to defer their mortgage payments for up to six months.

The coordinated announcement came from the Bank of Montreal, CIBC, National Bank of Canada, RBC Royal Bank, Scotiabank and TD Bank, and will be granted on a case-by-case basis to assist those disrupted by the COVID-19 pandemic.

“These measures are an important first step and underscore the resilience of Canada’s financial system and the strength of our major banks,” the joint news release reads. “Banks will monitor evolving economic conditions and consider other measures if necessary.”

“These measures are an important first step and underscore the resilience of Canada’s financial system and the strength of our major banks,” the joint news release reads. “Banks will monitor evolving economic conditions and consider other measures if necessary.”

The announcement has clearly come as a relief to many who have been laid off temporarily and worried about how they will cover their mortgage payments in the coming months.

One mortgage broker-owner wrote on Twitter that his office had received 26 calls before noon on Tuesday from clients inquiring about the 6-month deferral option.

The Canada Mortgage and Housing Corporation (CMHC), which provides default insurance for insured loans, also announced that it will allow up to 6-month deferrals for mortgage payments.

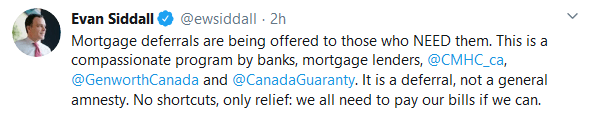

In a Twitter post, CMHC President and CEO Evan Siddall thanked the banks for stepping up to assist mortgage-holders. But he also reminded borrowers that these deferrals are not a blanket measure available to all mortgagors.

“Mortgage deferrals are being offered to those who NEED them. This is a compassionate program by banks, mortgage lenders,@CMHC_ca, @GenworthCanada and @CanadaGuaranty,” he wrote in a separate post. “It is a deferral, not a general amnesty. No shortcuts, only relief: we all need to pay our bills if we can.

In addition to the mortgage payment deferral measure, CMHC published a reminder that it and other mortgage insurers offer additional tools to lenders that can assist homeowners struggling though financial difficulty. “Our default management tools include: payment deferral, loan re-amortization, capitalization of outstanding interest arrears and other eligible expenses and special payment arrangements,” it noted in a statement.

How Are Other Mortgage Lenders Responding?

MCAP

MCAP, one of the country’s largest independent mortgage financing companies, has reached out to its clients reminding them of existing mortgage features they can take advantage of. Those include MCAP’s Skip a Payment Program, where homeowners may skip a payment at any time, as well as its Hold a Payment Program, which allows payments to be deferred for a specified period of time.

“Given recent global events, MCAP understands that these may be difficult times for its homeowners,” the company posted in an online notice to clients.

While its call centre is experiencing heavy volumes, clients can contact MCAP here.

Equitable Bank

“At Equitable Bank, we are standing alongside Canada’s six largest banks to help provide financial relief to Canadians impacted financially by COVID-19,” noted CEO Andrew Moor in a statement. “We are committed to working with personal and small business banking customers on a case-by-case basis to provide flexible solutions that help them manage through challenges such as pay disruption, childcare disruption due to school closures, or challenges resulting from the COVID-19 virus itself. This support will include up to a six-month payment deferral for mortgages.”

Moor told CMT that nearly the entire EQ Bank team is now working from home for the safety of them and the community, and that clients can best reach out with questions via email at customerservice@eqbank.ca.

“Obviously there are a lot of calls and it is tough to live up to the service standards we aspire to, but our customers should be assured that we will get back to them and will act in a sensible and compassionate manner,” he said. “Equitable Bank is here to help our customers.”

Home Trust

Home Trust, one of Canada’s leading alternative lenders, published its own statement on Tuesday.

“At Home Trust, we recognize that the COVID-19 virus is creating unprecedented challenging circumstances for everybody,” it reads. “We are committed to work with our customers on an individual basis to support you as you manage through these extraordinary times. If you have been directly impacted by COVID-19 and need to better understand your options with Home, please reach out to us…”

Those wanting more information can contact homehelps@hometrust.ca or call 1-855-270-3630, but are warned of high call volumes.

First National

First National, Canada’s biggest non-bank lender, has also adopted similar measures.

“We fully understand many of our customers are personally impacted by COVID-19. We understand there may be a need for payment assistance and are committed to working with customers on a case-by-case basis to help solve payment concerns,” Scott McKenzie, Senior Vice President, Residential Mortgages at First National Financial told us.

“Every situation is different and will be quickly assessed by our customer service team to come up with a solution that works for each borrower, which may include deferring mortgage payments up to six months.”

Clients wanting more information can email customer@firstnational.ca or visit www.firstnational.ca/mymortgage.

Please, clarify if the deferral including the interest because some banks are insisting that the interest for the number of months will be added to the principal.

Thanks

FOLA – deferring your mortgage payments is exactly what it sounds like, you are deferring them to a later date. Your interest that should of been paid is added back to your mortgage principal and will have to be paid. you are also paying interest on the interest that is added back since it’s being added to principal. You should not defer your payments longer than you absolutely have to and you should not being doing it if you don’t have to.

How am i able to find any info on mortgage defferral have tried to call cibc but no luck at all i went to bank hoping they would help but they dont know anything so what should my next move be i am s senior who is working to pay the mortgage and being sent home with no salary is a big blow. Thank you isabell devine

CIBC is tough to get through to. I gave up after 2 hours on the phone. Go to CIBC.com/covid-19, then click the Learn More button. Then click on the financial assistance form. Fill it in and they will call you back.

I live in Edmonton, I called my mortgage holder ICICI

For the 6 month deferral I heard on the news because I’m home taking care of my 5 year old & all my work is shut down. ICICI told me I did not take the insurance option they offered me when I purchased my home.

So they will only give me 1 month deferred mortgage payment.

I’m hoping Coronavirus blows over quickly or I’m not sure what I will do ?.

In regards to the interest,

Yes, you will still be responsible for the interest if your bank defers your mortgage payment or payments. you will still pay interest on the month’s your deferring the payments

And then again at the end when you pay the deferred payments.

The lady I spoke with at ICICI

Told Me I will still have to pay them $484.70 Next month on the 1 month deferred payment they approved me for.

I hope this helps ppl.

Hello,

I called First National for my mortgage deferral and also wrote an email and this was 2 days ago with no reply. I’m a nurse and there’s alot of concern of my health being affecting and my mother whose a senior. If there someone who I can call, maybe a direct line since I was told to write an email.

I hope someone on your response team can help me out,

Thank You.

With Mortgage deferral, does it mean that if you deferred it for 6 months (e.g $1000 a month), you have to pay the $6000 back after that 6 months+interest? or how does it work, sorry I’m new to this and needed more understanding on the matter. Or does it depends on what agreement you have with the bank/lender? Got so confuse especially with the COVID-19 on the corner.

Your mortgage payment is 200$. 100$ goes to interest , and 100$ to principle balance. If you defer for 6 months. Bank will add 600$ to your mortgage total and your overall mortgage payment will go up to reflect that.

If you want to keep payments down, you have option to apply for increasing mortgage time from 25 to 30 years if you qualify.

If this is the case, how come I have not received an e-mail from the Royal Bank ?