At last count, the average consumer had $25,163 of non-mortgage household debt.¹

At last count, the average consumer had $25,163 of non-mortgage household debt.¹

The average household carried an additional $74,667 in mortgage debt.²

Revolving credit has been a primary driver in overall indebtedness levels, jumping 17.5% year-over-year (as of the most recent figures from TransUnion).

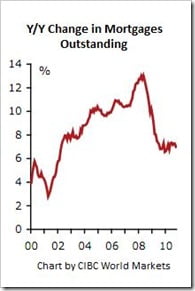

Mortgage credit rose 7.6% annually over a similar timeframe. CIBC says that figure is closer to 7% now, and is estimated at 5% for 2011.

Looking forward, the growth rate for mortgage debt will slow as home prices moderate and interest rates climb. The government’s new mortgage restrictions will curb volume even more.

Looking forward, the growth rate for mortgage debt will slow as home prices moderate and interest rates climb. The government’s new mortgage restrictions will curb volume even more.

CIBC says, “We expect that the move to shorten amortization from 35 years to 30 years will cut the growth in mortgage originations by 2-3 percentage points in the coming 12 months.”

As for non-mortgage credit, it’s “already decelerating,” says CIBC economist Ben Tal. Unfortunately, the new debt consolidation limits (i.e., the government’s new 85% LTV cap on refinances) could prop up consumer credit levels until rates resume rising.

¹ Source: TransUnion as of third quarter 2010. Non-mortgage debt is primarily car loans, with credit card purchases a distant second.

² Source: CAAMP as of August 2010. Household mortgage debt = $1.008 trillion in mortgage credit / 13.5 million households. This includes households that have no mortgage.

Chart source: CIBC World Markets

Rob McLister, CMT

Unfortunately, the new debt consolidation limits (i.e., the government’s new 85% LTV cap on refinances) could prop up consumer credit levels until rates resume rising.

Or, people could stop spending so much!

(which wouldn’t be good for the economy either, but would be more sustainable)

Hi there,

What happens if when you first got your mortgage, your amortization was at 40 years but you are renewing this year..

Can you then keep your 40 yrs amortization or does it have to be converted to 30 yrs?

Thanks

I checked out the TransUnion link, and it appears they are only talking about auto loans (which I assume means the vehicle is collateral) and credit cards. There is no mention of unsecured loans, so the average non-mortgage debt could be higher.

I find the method of calculating the avergage mortgage debt unusual. By including households that have no mortgages, it understates the average size of a mortgage by an unknown amount.

Neither of my obvservations are overly critical given that the goal appears to be comparing year over year data. But it does limit the usefulness of this data for other purposes, and both these figures understate the average debt loads that are being carried.

Hi Howdy,

TransUnion references both installment loans and lines of credit under “National and Regional Statistics.” I’ll try and get the breakdown and post it.

The average mortgage calculation spans all households. This reflects the degree to which mortgages affect all Canadians. As noted, this includes people without mortgages.

The average non-mortgage debt calculation spans all consumers tracked by TU. This reflects how non-mortgage debt affects all households. Likewise, TUs numbers include people with little or no non-mortgage debt.

If you’re interested in the average mortgage size, among only mortgage holders, it is $145k (CAAMP) to $146k (Ipsos Reid).

Cheers…

Hi Vonny,

You can still renew or switch lenders, subject to that lender’s normal lending policies. You can’t increase the mortgage amount, LTV, or amortization though.

Cheers…

Thanks for the reply,

I get it now, they gave an overall picture including all non-mortgage debt, and got specific for credit card and auto. This line threw me off:

“TransUnion released today the results of its analysis of trends in the credit card and automotive lending industry…”

It’s interesting that average mortgage debt comes close to doubling when only counting those with mortgages. It suggests around half of households have paid off their mortgage or rents.

If Flaherty prevents people from paying off high interest debt with low interest debt then we’ll have more high interest debt. Seems pretty obvious.

It doesn’t matter what the government does. People won’t stop spending unless rates go up.

You could top-up the mortgage with new funds so long as the ltv remains below 85% and the new funds are amortized over 30 years.

Re the mortgage debt issue RBC has clarified that conventional mortgages will continue with 35 year amortizations.

Only High Ratios will be at 30 years from March 18 as required by our Fed.

The other new rules too, I understand, will apply just to High Ratio Mortgages.

Rob, would you know if any other bank has clarified their position?

FN

I think Vonny has established that his amortization would already be over 30 years at renewal. I am assuming he wants to keep it that way and that his loan to value is above 80%.

If that is the case, how could you top up or add more funds? It would be considered an equity take-out and CMHC won’t allow that with an amortization over 30 years.

If Flaherty prevents people from paying off high interest debt with low interest debt then we’ll have more high interest debt. Seems pretty obvious.

Assume a spherical cow…. :)

You’re taking a pretty dim view of the average consumer. Once people see that they can no longer pay off their credit cards with their home equity, they will be less inclined to abuse their credit cards so much. People aren’t so dumb that they will just keep on spending until bankruptcy.

The new funds are amortized over 30 years, the existing amortization is above that, the new amortization ends up somewhere between 30 years and the original amortization.

The LTV has to be below 85% based on the current value and new mortgage balance.

Why not take a dim view of consumers? The government sure as hell isn’t giving us credit. Otherwise it wouldn’t have ripped away people’s freedom to manage their mortgage payments.

All these rules do is hurt home prices and force people with debt to pay higher interest rates. I don’t know about anyone else but I’ll be doing my part to see that Flaherty is voted out of office.

@Blended Amortization: I’m confused. I thought a mortgage charge can be registered with only one amortization.

Adding new funds to a high ratio mortgage would require a refinance right? The insurers require that refinances after March 18 are registered with a 30 year amortization. So can you explain exactly how Vonny will be able to get new money AND keep a 35 year amortization on the old money?

Thank you.

I wanted to follow up on this as promised. We heard back from TransUnion and they confirmed: “The debt includes everything reported to us except mortgages, which is 95 percent or more of the outstanding non-mortgage debt that is not a payday loan.”

They didn’t have a breakdown of the non-mortgage debt available.

Cheers…

Rob

Hi BA,

Just thought I’d pass this along. We have been told that no blending of amortizations will be permitted on high-ratio CMHC-insured top-ups after March 18. Whenever new money is added above 80% LTV, the total combined amortization will need to be 30 years or less if it’s insured.

Cheers…

That’s what I’ve heard as well…