Almost three years after Fraser Smith passed on, the financial technique he popularized (the Smith Manoeuvre) is still actively used. One of the most common questions prospective Smith Manoeuvre users have is, “What is the best mortgage to do it with?”

That answer hinges on where you trade, the mortgage rate and terms you receive, and who advises you on your investments, among other things. But if you’re a self-directed investor, one solution stands out: the Scotiabank STEP.

The STEP is one of just a handful of mortgages well suited to the Smith Manoeuvre. It has:

- Automatic readvancing (i.e., as you pay down the mortgage, you can instantly re-borrow that money)

- Support for hybrid mortgages

- Excellent prepayment options

- Intuitive online access

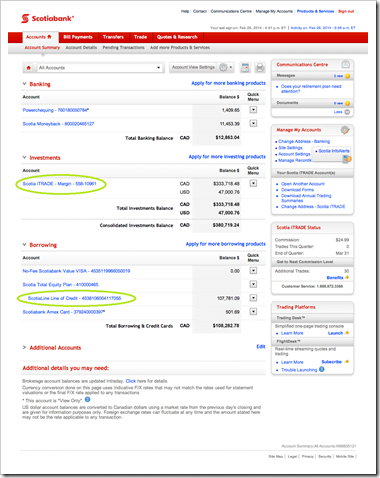

For do-it-yourself types who plan to borrow to invest, there are few solutions as integrated as iTrade and the STEP. For one thing, you can log in to Scotiabank’s website and view your mortgage balance, line of credit (LOC) balance and iTrade account balance(s) all on the same screen.

You can also use Scotia’s website to transfer funds directly from the LOC to your iTrade account. Simply pick the “from” account, the “to” account, the amount and the effective date. (Inquire with Scotia about automating funds transfers.)

Scotia’s solution eliminates a step required by some competitors, which make you first move money from the LOC to a chequing account, and then transfer it to your investing account. This convenience matters since leveraged investing strategies require regular funds transfers.

Other lenders connect your investments and mortgage as well (e.g., RBC and BMO), but none combine the mortgage features of the STEP, the breadth of iTrade’s investment and account options, and the linkage between investing and credit line accounts like Scotiabank.

Notes: Leveraged investing entails risk. Get professional advice from a licensed financial advisor before you consider it. Disclosure: Some of our staff maintain personal investment accounts, held by the firms in this story.

Rob McLister, CMT (email)

I wonder what Scotia paid to run this ad, I meant article

Hey Jessi, We approached Scotia for this story a while back after hearing about the link between iTrade and their STEP mortgage. Many folks don’t know it exists and it’s a benefit to those who want to do the Smith on their own. By all means, if you have any constructive thoughts on this topic, don’t hesitate to share.

Hello, Does anyone have suggestions on where to find a fee only financial planner who is knowledgeable about the Smith Manoeuvre?

Hey Rob any idea how National Banks’ process is to do the same?

Only issue with the Scotia STEP is 3 mortgage and 3 LOC portions max vs the AIO’s 99. Makes a difference particularly for those investing in real estate and wanting the “down payment” accounts to be separated accordingly.

The most important thing to consider when choosing which lender to use for the Smith Manoeuver or any other form of investing with LOC funds where the interest is being tax deducted for that matter is whether or not those funds are separated from any other funds used out of the LOC. If you were to borrow some funds out of the LOC for the Smith Manoeuvre, and funds out of the same LOC for a personal purchase, it opens the door for Revenue Canada to potentially invoke the tracing rule during an audit. If the LOC is subsequently paid down after borrowing funds for both personal and investing use, Revenue Canada takes the position that borrowed funds used for investing are paid back before the borrowed funds for investing, and they will retroactively reduce the eligible tax deductible amount on the interest claimed accordingly, and the onus is put on you to prove otherwise. If you are using the same LOC for both investing and personal use, this is very difficult to overcome. The best thing to do is use a lender that allows for multiple LOC portions/accounts under the same title charge. For this reason I have brokered the vast majority of Helocs where interest was to be tax deducted with National Bank under the all-in-one program. The all-in-one allows the borrower to easily set up multiple LOC, mortgage portions, checking accounts under the same title charge, at a low monthly cost for the additional accounts. I advise my clients to set up a stand alone LOC and checking account for each chunk of borrowed funds where the interest is going to be tax deducted. It makes record keeping for the interest right-off very easy, and should prohibit Revenue Canada from challenging the validity of the write-off in case of audit.

It ‘s a good tool Rob.. thanks for sharing. There will be some super exciting stuff in this area coming up in the near term.

Watch for some very cool RRSP and TFSA integrated plays…. good things ahead.

Good to know but in the interest of objectivity for DIY investors who have a brokerage account with other institutions, why not compare different integrations in more detail? As peachy as this review sounds, Scotia’s discount brokerage rankings slipped in Surviscor ratings from 1st place in Q1 2013 to 3rd place where they are now and J.D. Power gives Scotia iTrade 2/5 overall rating.

Great comments. Thanks everyone.

JP: These links might help: http://www.moneysense.ca/directory-of-fee-only-planners and http://canadiancouchpotato.com/find-an-advisor/

Kyle: National Bank permits bill-pay directly from their All-in-One credit line, which you can use to move money to online brokerages. Link: http://www.nbc.ca/WebInfoWeb/DispatchRequest?aliasDispatcher=VendorsList&lang=en&cust=XXX

The AIO account is also a full chequing account, theoretically supporting most normal funds transfer methods to/from chequing/brokerage accounts. In short, while you can’t view 3rd-party brokerage accounts on the same interface as your National Bank AIO, it’s still flexible for funds transfers.

Regarding 99 portions, I’ve never met anyone who’s used more than 3 LOC accounts, but for those who do, the AIO is a good solution.

Daniel: Most definitely, for those who might need to borrow from a LOC and do the Smith Manoeuvre, having 2 or more LOC accounts is key. Most lenders with auto-readvanceables do support that option. CIBC is one notable exception.

Calum: Love surprises. Please keep us in the loop.

Lior: A full in-depth comparison would be useful, albeit beyond the scope of this piece. I’d caution anyone about putting too much weight on a 1st or 2nd place rating that’s separated by just 3%. (And to clarify, iTrade is tied for 2nd in the report you mention…after being 1st for 2 years). These ratings are necessarily subjective but if you really want to dissect the ratings, it’s easy to take issue with the weightings. For example, where BMO might appeal to those wanting automated advice/asset allocation and easy account opening (a 1-time benefit), many would give the nod to iTrade’s trading interfaces, U.S.-Friendly RRSP, Buck-a-Bond program, commission-free ETF list, among other things. How does one weight that stuff? Suffice it to say, iTrade’s trading platform, the STEP’s flexible mortgage features and Scotia’s LOC/trading integration–as an overall solution–is second to none for DIY Smith users, in at least one author’s experience.

I’m a huge fan of Scotiabank (it was my first bank as a kid, an account I continue to hold). Since then, I went on to do my investing with TradeFreedom Securities, which Scotiabank purchased and fully integrated into Scotia iTRADE (too often, companies make acquisitions but leave them on separate technology platforms, databases and in separate subsidiaries; not so with Scotiabank). I’ve since consolidated my investment assets from a former employer’s defined contribution pension plan/Group RRSP with Scotia iTRADE and qualify for their rebranded “loyalty pricing” of $9.99/trade when you maintain aggregated assets with Scotia iTRADE (that is, they look at ALL your Scotia iTRADE accounts you hold jointly or by yourself unlike BMO InvestorLine and TD Direct Investing Canada which require $25,000 minimum per registered plan) of $50,000 CAD.

As of this week, they’ve now expanded that, likely through banking platform improvements that allow this, allow more Scotiabank banking customers to benefit from loyalty pricing – taking into account line of credit, mortgage, HELOC, chequing/savings deposit, GIC and ScotiaFunds balances – which are updated by end of business day for Scotia iTRADE “loyalty pricing”. No more waiting until end of quarter like HSBC InvestDirect (which, like BMO and TD Canada Trust, charges an annual fee when you don’t maintain $25,000 in each registered plan) to qualify! I think this is a good strategy to compete with the likes of RBC Direct Investing, which has no minimums to qualify for “loyalty pricing,” because this allows basically everyone to qualify but still requires some form of loyalty to the institution through increased share of wallet.

The only downside(s), and they are small, would be you’re limited to Scotia Capital, Thomson Reuters, ValuEngine and Sabrient equity research reports. I’d prefer to see one (or more) of those removed and see S&P Capital IQ and/or Morningstar reports added. As well, they don’t offer D- or F-series of mutual funds, which have lower MERs, and their commission-free ETF list is quite minimal.

One more big plus: if you maintain only a Money Master Savings Account with Scotiabank like I do, you can still enjoy free in-branch or ABM deposits, no holds on deposits up to your “cashback” limit, and free self-to-self transfers to any Scotiabank product (including mortgages, safe deposit box annual rent, credit cards and Scotia iTRADE, among others). This allows you to transfer money out of Scotiabank for no fee, by way of Scotia iTRADE and then onto one of your linked external accounts. I do this with transferring money in/out of Tangerine Bank, which is my primary day-to-day bank account and also now owned by Scotiabank.

I look at Scotia’s strategy this way: all roads lead back to Scotiabank.

They’re just beginning their partnership with Canadian Tire Financial Services, with a 25% equity stake to close by the end of September (and the option to increase to 50% within five years – or sell their 25% stake back to Canadian Tire if it’s not beneficial) and funding 100% of the new credit card receivables. I think you could see the small deposit business of Canadian Tire Bank abandoned because they no longer need to self fund their credit card business and those deposit clients transitioned to Scotiabank and/or Tangerine. I think you could see in-store unmanned kiosks full of Scotiabank/Tangerine banking product brochures and Scotiabank ABMs, perhaps even full-service, in all or strategically-located Canadian Tire stores. As well, Tangerine has committed to launching a rolling 3-month mobile pop-up kiosk in cities across Canada to radically drive new customer growth.

I think you could see Scotiabank do another major acquisition in the dealer finance space, perhaps a RIFCO Auto Finance might make sense. Carfinco could also be a good buy in the space, but given they’re in the “D space” (instead of the “B or C space” like RIFCO), I see that as less likely – unless TD Canada Trust or National Bank nab RIFCO first.

Scotiabank also sees the value of BOTH mobile mortgage teams (which they’re expanding into mobile sales teams, to allow for mobile mutual fund sales specialists) AND mortgage brokers. They’re willing to bring in new clients with mortgages and keep them even if they only have a mortgage with Scotiabank. They won’t make much money on them but shouldn’t lose money either. The value is in that cross-sell opportunity. With ever-tightening do-not-call and anti-spam legislation to non-clients, Scotia is amassing probably the largest customer database so that, essentially, they don’t need a phone book. Through their various partnerships, they can probably call pretty much anyone in Canada who is related to them in some way (through Canadian Tire, through SCENE, through Scotia Dealer Advantage, through their mortgage broker, etc.).

Cheers,

Doug M.

Disclosure: I am a long-term BNS shareholder but also hold shares in CM, TD and HSBC (London quoted ordinary shares, not the ADRs).