No rate cut surprises to report today.

Canada’s key lending rate “remains appropriate,” said the Bank of Canada this morning. That’ll keep prime rate at 2.85% for now.

The BoC’s economic commentary today was both grim and hopeful. The economy “stalled” in the first quarter, it admitted—thanks in part to the “oil-price shock.”

Looking further down the road, however, we got more of the same brand of optimism we’ve come to expect from the Bank—i.e., that the economy will get back to “full capacity” in a few years or less. In the meantime, the Bank says our cheapened loonie and widening output gap will “offset each other,” keeping inflation near 2% on a “sustained basis.”

What does sustained mean, you ask?

Well, barring some out-of-left-field inflation catalyst, the Bank’s assessment portends little probability of rate hikes in 2015. And financial markets agree. OIS traders are pricing in a 44% chance of a rate cut by year-end, according to Bloomberg.

As a result, “interest rate relief” will continue to provide a “cash flow…buffer” for indebted consumers, said Governor Stephen Poloz in today’s press conference. That is particularly true for variable-rate mortgagors.

“On the surface, lower interest rates would be expected to promote more borrowing, which would increase this vulnerability,” Poloz noted in his prepared remarks. “However, in the near term, lower borrowing rates will actually mitigate this risk, by reducing payments for mortgage holders and giving us more economic growth and employment gains. “

That’s all good, but with Toronto/Vancouver home prices on a Saturn V rocket trajectory, mortgage policy-makers have to be wondering if and when they should apply the housing brakes.

CAAMP CEO Jim Murphy believes Ottawa better not jump the gun just yet. “Canada is now two housing markets. One, Vancouver and Toronto, and two, the rest of the country,” says Murphy. “In recent visits to Ottawa and in discussions with government officials, CAAMP has highlighted the [existence of these] two housing markets…Any further changes would impact markets that are not seeing house price appreciation or, in some cases, actual price declines.”

OK, but what about two sets of mortgage rules—one for richly valued markets and one for weaker markets?

“It’s a very interesting question,” says Murphy. “The same issue has been raised with the Bank of Canada about regional interest rates—higher in a region with a strong economy and lower elsewhere. I’m not sure that is possible.”

“For mortgage rules, it may be possible, but it’s still difficult. For, example, do mortgage rules apply to the City of Toronto or to the GTA?”

For now, it looks like the status quo may prevail. “The federal government continually monitors the housing market and consults with stakeholders like CAAMP to gauge opinions on the market. Our sense is that changes are not imminent and are unlikely before the October federal election.”

Barring significant mortgage rule tightening, it may take an economic downturn or improbably large rate hikes to derail single-family price momentum (national numbers are being skewed predominately by single-family home sales in Toronto/Vancouver). And neither seem imminent.

That said, the “data never go in a straight line,” Poloz remarked earlier, and we have no way of knowing what’s around the corner. Will the U.S. Federal Reserve finally jack up rates and pressure the BoC to follow? Will oil prices rebound or fall to new lows? Will a U.S. recovery and hobbled loonie boost demand for Canadian exports? Will EU stimulus work, or backfire? Is another financial crisis waiting in the wings? Fill in your own ‘what if’ here _____________. Any of these possibilities could play on rates in the year to come.

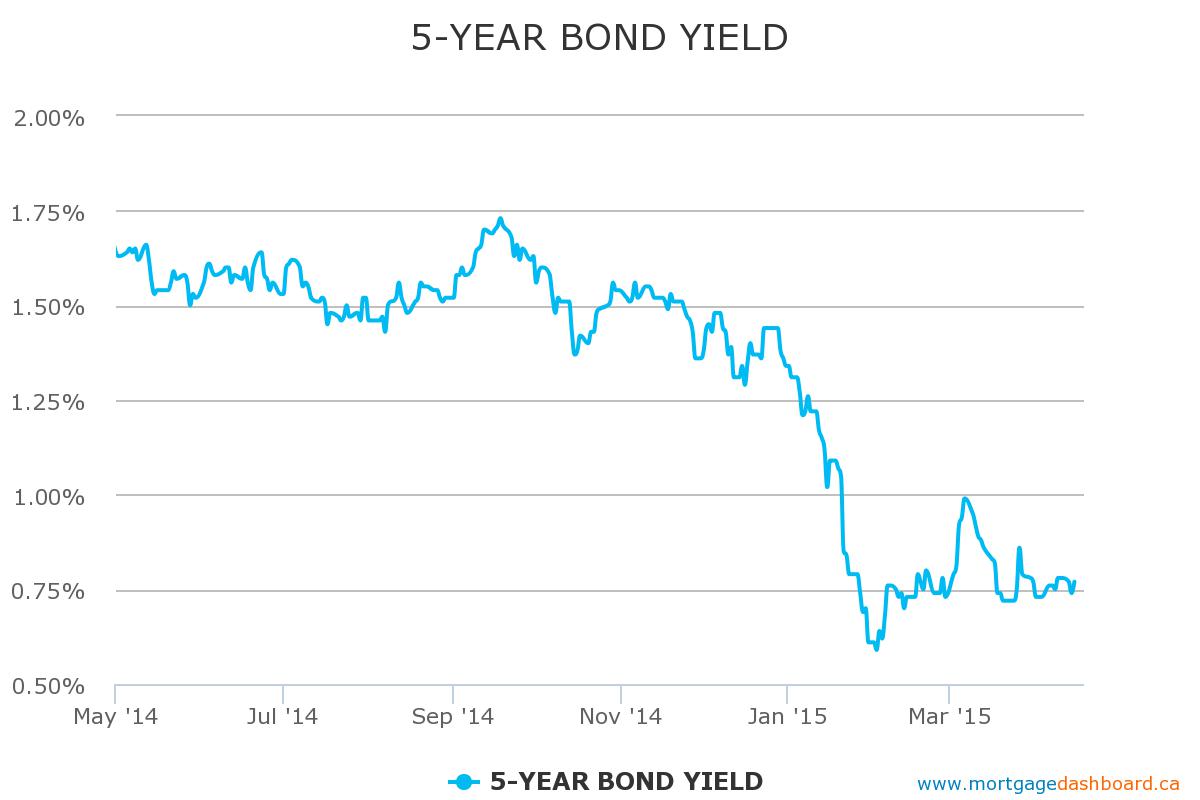

Meanwhile, we’re just a stone’s throw from a new record low for Canadian bond yields. Our most important fixed mortgage rate driver, the 5-year bond yield, rose 3 basis points on today’s news. But if we break below 0.55% and hold there, look out. Five-year mortgages near 1.99% could rocket Toronto/Vancouver prices from the stratosphere to the exosphere.

Sidebar: Here’s the full text of today’s BoC’s statement: Link. The next Bank of Canada interest rate pow wow is May 27, 2015.

Great job Robert

Good article Robert i really enjoyed reading. :)

There is no question that Vancouver and Toronto are hot real estate markets. The conclusion appears to be that low interest rates are the cause. This is erroneous, in my humble opinion. It is illogical that only two markets would be affected when interest rates are identical from coast to coast. If the interest rate variable is the same in all markets then it must be another variable that is causing such an obvious bifurcation of the Canadian real estate scene.

Let’s be clear, it is far more likely that demand is what is driving up prices in T.O. and Vancouver. The invisible hand is clearly at work and any attempt at manipulating the market, especially through regional lending rules or differentiated interest rates, will likely have unintended and negative consequences.

It is far more beneficial to focus on excellent underwriting practices, and leave the market alone.

Hi Appraiser, There’s little question; home prices in Toronto and Vancouver would have caught fire even without historically low rates. Among other reasons, there’s just no place to build cheaply anymore in locations where the growing population really wants to live. That’s especially true for single-family homes. Record low rates simply fuel this fire because they motivate/allow more buyers to afford and compete for the same limited inventory.

.. sort of related.. my note(below) to applaude today’s May (11) Finanacial Post Article (Teresa Tedesco)

which I think is applicable to”mortgage/residential real estate” in Canada–Balanced article unlike a lot we have seen the last decade or so

Dear Ms Tedesco: As a Finanacial Planner, I really appreciated the different slant on your recent article– ” consumer indebtedness in Canada.”

All those articles over last decade or so with politicans, bureaucrats & academia berating Canadians in financial Management seems rich given spending habits in their workplaces.Average Canadian family is somewhere between 4-6 th richest consumer, on average in the world according to recent articles. (R E Bear & editor Rob– yes I know net assets includes housing assets which for many higher net worth canadians often are F & C)

two quick points:

1) Interesting (at least to me) that the federal and provincial governments spend less wisely than the average consumer & none amortize (unlike Canadian mortgagor) their long term debt.

2) According to Fraser Institute,an average two-wage family in Canada earning $100,000 would pay anywhere from *$36,800 (Alberta) to $ 47,600 ( NF. & Lab.).in all levels of taxes* per annum. Although less debt is better than more, seems the real problem is net income (after all taxes) is relatively quite low.

Widely reported that the typical family pays more in taxes than they do on housing, food & clothing–COMBINED.

(Fraser institute*)–What types of taxes are included?

A: The Personal Tax Freedom Day calculator, like Tax Freedom Day, includes all taxes from all levels of government that Canadians pay. This includes: income & sales taxes; liquor, tobacco, amusement & other excise taxes; automobile, fuel, & motor vehicle licence taxes; CPP/QPP and EI contributions, medical & hospital taxes; property taxes; import duties; profit taxes; and natural resource levies.

Regards, David

………8 years a mortgage originator

David Johnston, CFP, M.T.I.