National home sales and property prices both declined in February compared to a year earlier, the Canadian Real Estate Association’s (CREA) latest monthly data shows.

Canadian home sales declined 16.9 per cent, while the average selling price dropped 5 per cent year-over-year to an average of $494,000.

The hot Vancouver and Toronto markets, even though they’ve stabilized somewhat since their peak in early 2017, are still driving up the average price for the whole country. By excluding these two markets the average price of a Canadian home is $112,000 lower, at just $382,000.

Similarly, much of the double-digit sales decline is due to seller uncertainty in Toronto and Vancouver. Provincial legislation introduced last year intended to cool those local housing markets, namely the Ontario Fair Housing Plan and the British Columbia’s foreign buyers tax, had a largely psychological effect—sellers who were sitting on their homes waiting for the right time to sell largely decided to take the plunge and list.

A flood of inventory then entered the market, which led to the sales plunge, so oft-dramatized in media headlines.

Properties, however, are still selling, just not as fast as they were at their peak this time last year. Inventory, in fact, is still at near-record lows. So although the supply is indeed up, it’s still not enough to meet demand in our hottest urban markets.

Prices, therefore, are still likely to rise in the mid-to-long term.

Another reason activity is slow in the first quarter of 2018 is because prospective buyers rushed to buy houses late last year before the federal banking regulator, OSFI, tightened mortgage lending rules, which came into effect on January 1. Fearing being forever left out on the property ladder, prospective buyers rushed to buy what they could afford, or stretch themselves to afford,which is why we saw condos—by far the most inexpensive market segments—post the largest year-over-year price gains.

Overall, the vast majority of the country has a balanced housing market, meaning neither sellers nor buyers have the upper hand. The national sales-to-new listings ratio, the measure used to gauge housing market conditions, is just 55 per cent this February, well within the “balanced” range.

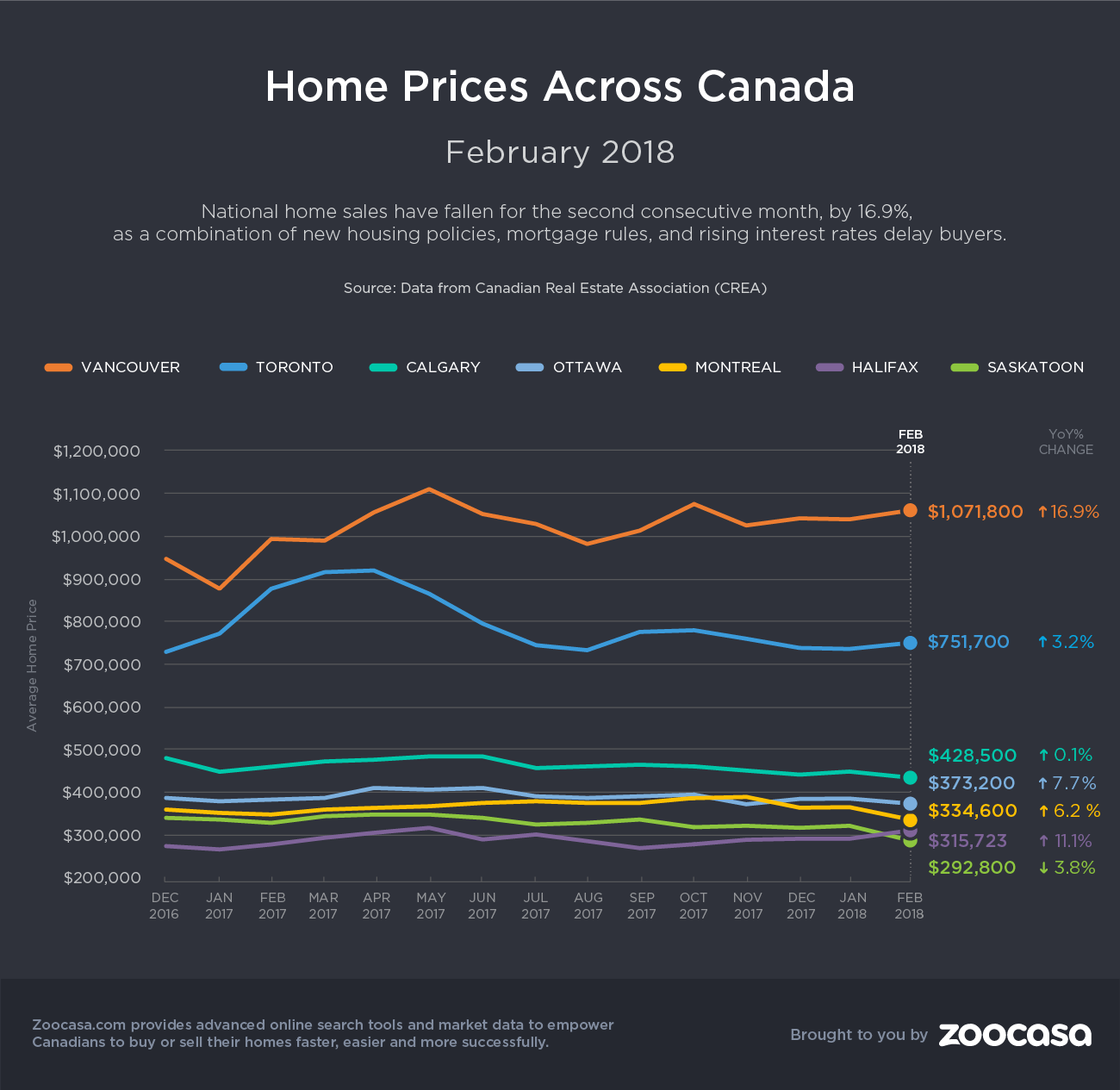

Vancouver continues to win the dubious honour as the most expensive city in which to buy a property, with the average price up almost 17 per cent to $1,071,800.

That may change as we head into the busy spring and summer months, especially since B.C recently announced 30 new measures to make housing more affordable. As we saw from Ontario’s Fair Housing Plan announcement last spring, the announcement itself is likely to introduce uncertainty and confusion into the market.

Canadians looking for an inexpensive urban centre in which to purchase a home would do well to look to Saskatoon and Halifax, with their fairly robust job markets and houses selling around the $300,000-range.

Check out the infographic below for more details:

Danielle Kubes is a content writer for Zoocasa.com, a leading real estate resource that combines online search tools and a full-service brokerage to empower Canadians to buy or sell Toronto homes for sale, Hamilton real estate and property across the country.

This is another BS article trying to cover the fact that the Canadian real estate market is CRUSHING … big time

Canadian housing marketing is not crashing but may have flattened in some markets. Definitely sales are down but house prices have not dropped overall….yet! The concern is household debt and rising rates as these mortgages come up for renewal. Will households be able to afford what they currently owe? Canadians are addicted to debt and cheap money.

Ya…governments control housing markets by introducing one politically motivated policy after another…so then everyone becomes a lifetime renter. It’s not a crash it’s called communism.