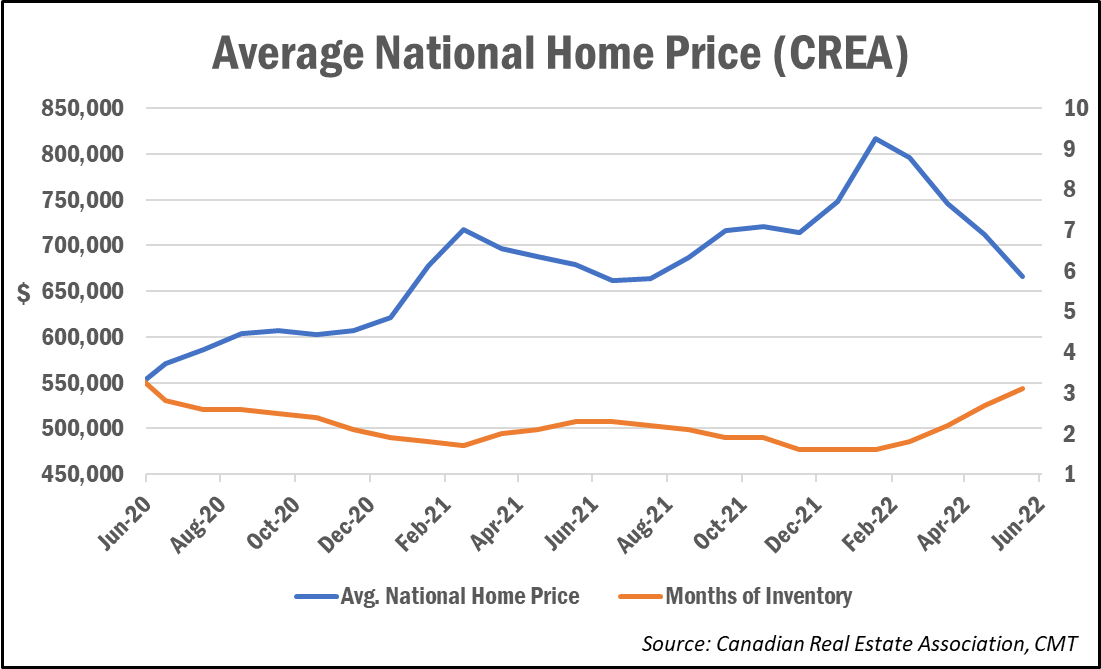

Average home prices in Canada fell for the fourth consecutive month in June, while home sales were down in three-quarters of all markets.

The average (not seasonally adjusted) home price fell to $665,850 in June, according to data from the Canadian Real Estate Association (CREA). That’s down 6.4% from the previous month and nearly 18% from February. Compared to a year ago, prices are down 1.8%.

On a seasonally adjusted basis, the MLS Home Price Index, which strips out month-to-month volatility, fell for the third consecutive month. It was down 1.9% month-over-month, but remains 14.9% higher compared to last year.

Meanwhile, sales were down 5.6% from May, falling in three quarters of all markets and in 7 out of 10 provinces.

“The cost of borrowing has overtaken supply as the dominant factor affecting housing markets at the moment, but the supply issue has not gone away,” said Jill Oudil, chair of CREA. “While some people may choose to wait on the sidelines as the dust settles in the wake of recent rate hikes, others will still engage in the market in these challenging times.”

The number of months of inventory rose to 3.1, a level not seen since June 2020. Still, CREA notes this is still “historically low,” given that the long-term average for this measure is over five months.

Removing the high-priced markets of the Greater Toronto and Vancouver areas, the average price stands at $551,350, which is 1.3% higher than a year ago.

The number of newly listed homes rose 4.1% month-over-month, driven by a jump in new supply in Montreal, CREA said. In the Greater Toronto and Vancouver areas, however, new listings posted small declines.

Cross-country roundup of home prices

Here’s a look at select provincial and municipal average house prices as of June, with their annual and monthly changes.

| Location | Average Price | Annual price change | Month-over-month change |

| Nova Scotia | $417,300 | +27.1% | -0.05% |

| Quebec | $514,925 | +11.8% | -1.7% |

| B.C. | $947,216 | +4.1% | +3.4% |

| Ontario | $881,475 | +2.8% | -6.3% |

| Alberta | $477,009 | +4% | -5.8% |

| Halifax-Dartmouth | $547,800 | +28.1% | -0.5% |

| Barrie & District | $906,300 | +17.4% | -5.2% |

| Greater Toronto | $1,204,900 | +17.9% | -4.5% |

| Victoria | $985,500 | +25.5% | +0.9% |

| Greater Vancouver | $1,235,900 | +12.4% | -2% |

| Greater Montreal | $546,800 | +12.7% | -1.6% |

| Calgary | $530,500 | +14% | -0.3% |

| Ottawa | $695,600 | +8.2% | -2.4% |

| Winnipeg | $360,900 | +6.9% | +2.4% |

| St. John’s | $316,300 | +9.1% | +2.7% |

| Edmonton | $409,300 | +8.3% | -0.1% |

Latest Bank of Canada rate hike yet to be felt

Prices have been falling as the cost of borrowing rises, driven largely by rising fixed rates and a string of rate increases from the Bank of Canada, which impacts variable-rate mortgages.

“The Canadian housing market continues to roll over as borrowing costs keep ratcheting up,” Randall Bartlett, Senior Director of Canadian Economics at Desjardins, wrote in a note. “And this week’s colossal 100-bps increase in the overnight rate by the Bank of Canada has yet to be felt or reflected in these numbers. With more rate hikes on the horizon, it’s tough to see relief coming any time soon for homeowners.”

TD Bank economist Ksenia Bushmeneva agrees, saying July’s “supersized” BoC rate hike and any forthcoming hikes will drive home prices and sales “even lower amid further pressure from borrowing costs.”

“Compositional effects should also continue to negatively influence average prices, as the exorbitant run-up in prices for more expensive units (such as detached homes) during the pandemic gives way to a steeper decline in this segment,” she noted.

Bartlett added that Desjardins now sees “roughly even odds” of a recession in 2023, “with residential investment providing the primary drag on the outlook.”