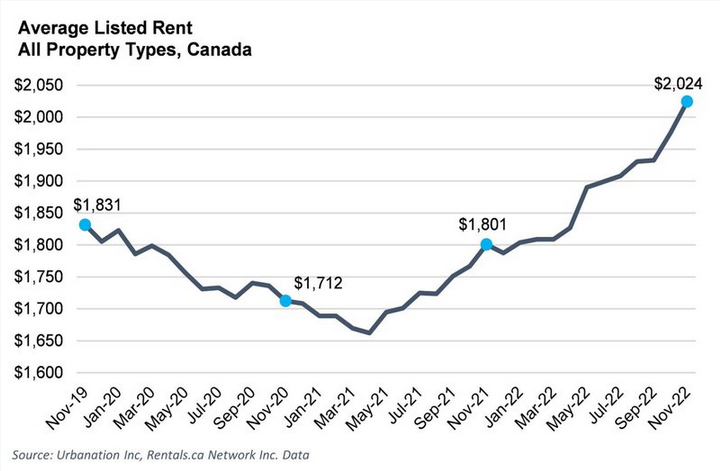

The cost of rent in Canada has been on an uptrend since the pandemic, and in November reached an average of $2,024.

That’s a 12% jump since last year and up 2.5% since October alone, according to recent data from Rentals.ca. Average rents are now up nearly 21% since hitting a low of $1,676 in April 2021.

“Rents in Canada are rising at an exceptionally high speed, which is having a profound effect on housing affordability as interest rates continue to rise,” said Shaun Hildebrand, president of Toronto real estate research firm Urbanation, which authored the report.

“With the most expensive cities experiencing very low supply and the fastest rates of rent increase, regions with high population growth are seeing demand shift into more affordable areas,” he added.

Atlantic Canada is the country’s third-most expensive market

The Atlantic provinces continued to see a steep appreciation in prices, with rents rising 31.8% year-over-year for purpose-built and condominium rentals.

The rental market in Atlantic Canada is now the third-most expensive in the country, behind British Columbia and Ontario, with average prices for 1- and 2-bedroom units at $1,716 and $2,032, respectively.

In comparison, rent prices were up 16% in B.C. and 15.3% in Ontario, with 2-bedroom units averaging $2,820 and $2,638, respectively.

Alberta also saw strong growth, with rent for purpose-built units rising 15% year-over-year, though 1-bedroom ($1,283) and 2-bedroom ($1,618) units remain comparatively more affordable.

The provinces with the slowest growth in monthly rent prices were Saskatchewan (+12.9%), Manitoba (+9.8%) and Quebec (+6.3%).

At the municipal level, here’s a look at the year-over-year rent increases in the country’s largest markets:

- Vancouver, B.C.: +24.3%

- Toronto, ON: +23.7%

- Calgary, AB: +21.9%

- Ottawa, ON: +13.7%

- Edmonton, AB: +9.2%

- Montreal, QC: +7.2%

A growing percentage of Canadian households are renters

According to data from the country’s latest census, there have never been more renters in Canada. As of 2021, nearly 5 million households rented, a jump from 4.1 million compared to 10 years earlier.

“While owner households still dominate the Canadian landscape by a ratio of two-to-one, renters accounted for most of the growth over the past 10 years,” RBC economists Robert Hogue and Rachel Battaglia wrote in a recent research report.

They noted that rentership increased by 876,000 households (22%) vs. a rise of 770,000 (8%) in owner households.

“Renting used to be a swift rite of passage to buying a first home. But there’s ample evidence that younger generations of Canadians aren’t progressing up the housing ladder (from rental housing to starter homes to larger homes) quite so fast,” they added.

RBC’s analysis of the census data found the ownership rate among millennials (1981 to 1996) is lagging that of previous generations, with millennials continuing to rent for an average of three to five years longer than their baby boomer (1946 to 1964) counterparts.

However, rentership is growing among the boomer generation as well. Between 2011 and 2021, baby boomers overtook millennials as the fastest-growing group of renters (+4%), a trend witnessed in municipalities of all sizes.

“The widespread shift toward renting suggests affordability issues in large urban areas may not be the only driving force,” the RBC economists wrote, suggesting rising immigration and an aging population are also supporting rental demand.

On average, newcomers to Canada generally rent for the first five to 10 years after arriving. And the “rapidly growing” immigration targets set by the current government “have significantly boosted demand for rental housing,” they said.

“And more Canadians are choosing to live alone. Since two incomes are often necessary to cover the high costs of ownership, many of these individuals end up renting,” they added.

“We expect these demographic and behavioural trends to continue fuelling demand for rental housing in the years ahead.”