Something unusual is happening across most Canadian housing markets this year. In the past, as the springtime was approaching, new home listings were usually rising more strongly than home sales.

This year, the opposite is the case.

Why is there a shortage of new home listings in Canada? What makes homeowners reluctant to bring their homes to the market? How is this trend affecting home prices? And most importantly, what can we expect for the remainder of this year?

A look at the latest data for the main markets in Toronto, Montreal, Calgary, and Vancouver suggests possible answers.

Among the best indicators of the state of a housing market are comparative trends in home sales and new home listings. The sales-to-new-listings (S/NL) ratio of, say, 0.5 simply means that in a given month there are 50 sales for every 100 new listings. Traditionally, a ratio in the 0.4 to 0.6 range is considered a sign of a “balanced” market, while ratios above or below that range indicate “sellers’” and “buyers’” markets, respectively.

The S/NL ratio in Canada’s housing market rose in all four months of 2023, from 0.53 in January to 0.72 in April. At this S/NL level, the country’s home market is clearly in “sellers’” territory where sellers have an advantage over buyers in a negotiating process. A look at the main regional markets confirms the trend.

In Toronto, the S/NL ratio rose steadily from 0.40 in January this year to 0.66 in April. This was in sharp contrast to the past trends (see chart below).

In the three years prior to 2023 (green, blue, and orange bars), the S/NL ratio was declining practically throughout the January to April period. This year, however, the ratio was on a strong and steady rise (grey bars).

In Montreal, the S/NL ratio grew in all four months of this year, from 0.48 in January to 0.71 in April. In Calgary, the S/NL ratio grew steadily from 0.65 in January to 0.86 in April, while in Vancouver it rose steadily from 0.28 in January to 0.54 in April.

Explaining the rise in home prices

Whenever the S/NL ratio rises and sellers have an advantage over buyers in a negotiating process, one can reasonably expect prices to rise and that is what is happening in Canada.

After declining by roughly 20% in 2022, the average resale home price has been on the rise so far this year and reached $716,000 in April. The rise happened in all four major markets: Toronto, Montreal, Calgary and Vancouver.

The expected continuation of price growth might have been among the reasons for the lack of new home listings. However, in addition to this psychological factor, there is one more “technical” data-driven reason for the low supply of new home listings—rising mortgage rates.

The role of higher mortgage rates

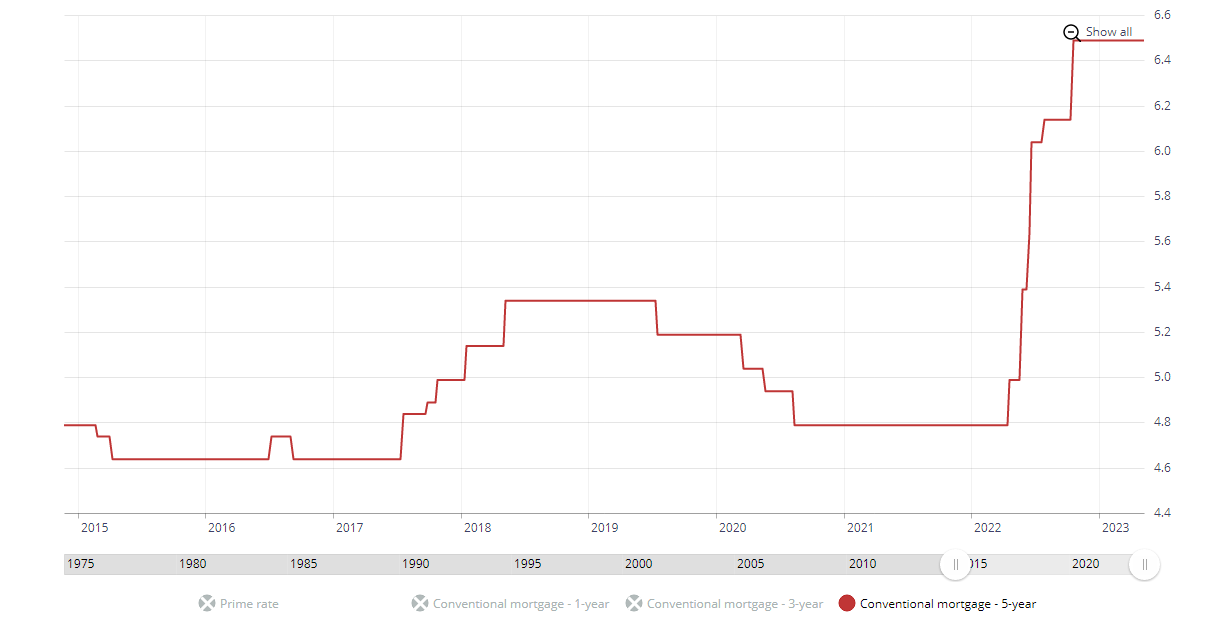

For several years, interest and mortgage rates were low before they started rising strongly in early 2022. The posted benchmark 5-year fixed mortgage rate surpassed 6% in June last year and stayed there thereafter (6.5% as of April 2023).

Posted 5-year mortgage rate

High mortgage rates have significantly reduced the number of potential homebuyers who qualify for mortgages. However, if you were among those homeowners who obtained a fixed-rate mortgage prior to early 2022, you are presently in the comfortable situation of making mortgage payments that are much lower than the payments of those who are seeking to get the same mortgage today.

As a consequence, you are less likely to be interested in selling a home and buying a larger home or downsizing because any new mortgage would come at a much higher rate than what you are currently paying.

In short, for those who hold a fixed-rate mortgage arranged prior to early 2022, selling a home and arranging for a new mortgage today does not look attractive. Hence, a lack of new homes that are being listed for sale.

How long will this situation last? The answer partially depends on the number of fixed-rate new, refinanced, and renewed mortgages issued in the few years prior to 2022.

Historically, the share of fixed-rate mortgages in all mortgages hovers around 50%. According to the latest CMHC report, the popularity of fixed-rate mortgages has increased further as these mortgages accounted for more than one half of all new mortgages in 2022. Thus, for many homeowners who have a pre-2022 fixed rate mortgage, selling a home in the present environment of high mortgage rates does not look appealing.

If this is the case, and as long as mortgage rates remain at present levels, the supply of new home listings will continue to be relatively low. This will likely last until the terms on most of the present fixed-rate mortgages issued prior to early 2022 expire.

Most of the holders of these mortgages cannot reasonably be expected to return to the housing market. In other words, barring any major economic downturns, the present “crunch” in the supply of new homes listed for sale in Canada, and a consequential rise in home prices, will likely continue for the remainder of 2023.

The combination of soaring construction costs, limited land availability, and stricter government regulations has hindered the pace of new home development. Additionally, the impact of the global pandemic and supply chain disruptions has further exacerbated the situation. As a result, homebuyers are facing increased competition and higher prices in a market that already struggles with affordability. This issue calls for innovative solutions and collaborative efforts from industry stakeholders and policymakers to address the housing supply shortage in Canada.