Canada’s economy outperformed growth expectations to end the year, which means the Bank of Canada could feel less pressure to start cutting rates in the near term, economists say.

Month-over-month GDP growth rose 0.2% in November, Statistics Canada reported today. That’s one tick above both economist expectations and StatCan’s own flash estimate from October.

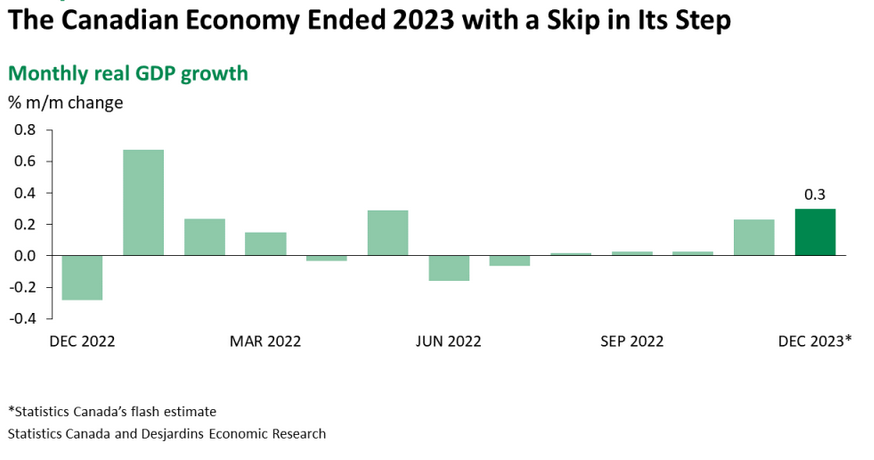

On top of that, the agency’s flash estimate for December is for even stronger growth of 0.3%, which would result in a fourth-quarter reading of +0.3%, or 1.2% annualized.

“Canada had a far firmer growth backdrop to end 2023 than expected, and this points to an upward revision to 2024 estimates,” wrote BMO chief economist Douglas Porter. “In turn, there’s also less pressure on the BoC to start cutting any time soon.”

Growth in the month was propelled by goods-producing industries (+0.6%), which recorded their strongest growth rate since January 2023.

TD’s Marc Ercolao said that, despite markets focused on the timing of the Bank’s first rate cuts, “a heating up of the Canadian economy may push expectations for a first cut further down the line.”

He added that the Bank is expected to remain in its current holding pattern until inflation settles “decisively” at its 2% inflation target, but that “strong data prints like today’s GDP release will be keeping the Bank on their toes.”

Economists at Desjardins said renewed strength in the final quarter of 2023 could lead to sustained growth and higher-than-expected inflation heading into 2024.

“However, we anticipate more economic weakness on the horizon,” they said, “as ongoing mortgage renewals at higher rates and slowing population growth weigh on the Canadian economy.”

December GDP should be taken with a grain of salt, some economists say

But some economists caution about reading too much into November’s positive reading and the even stronger flash estimate for December.

“The re-acceleration of growth towards the end of 2023 should be taken with a grain of salt,” cautions RBC economist Claire Fan, noting that early GDP estimates are prone to revisions.

“And a lot of the strength in November was due to one-off factors such as recoveries from earlier factory shutdowns and strike activities that are unlikely to be repeated in the following months,” she added.

Additionally, even an annualized growth rate of 1.2% for Q4 would mark the sixth consecutive quarterly decline when growth is measured on a per capita basis.

“Overall we continue to expect pressures from elevated interest rates to curb consumer demand, stalling growth in both output and inflation over the first half of 2024 before the BoC is expected to cut rates in June,” she wrote.

Statistics Canada will release December GDP data on February 29, 2024.