Scotiabank reaffirmed the strength of its variable-rate mortgage portfolio, despite the higher costs faced by borrowers due to rising interest rates.

The comments were made during the bank’s fourth-quarter earnings call on Tuesday, in which Scotia reported a 20% year-over-year drop in net income, but also an 11% increase in mortgage volumes.

Of Scotia’s $302 billion mortgage portfolio, $112 billion worth, or 37%, has a variable rate. The bank is also the largest mortgage lender to offer adjustable-rate mortgages, which are variable-rate mortgages with payments that fluctuate as prime rate rises or falls.

Because of this, the bank’s variable-rate clients don’t have to worry about hitting their “trigger rate,” since their payments are regularly adjusting to cover the higher interest costs.

“We believe strongly that a variable rate mortgage should have a payment that varies,” said Dan Rees, Group Head of Canadian Banking. “We are not seeing credit pressure in that category during Q4, full stop.”

He added that the bank is “having lots of conversations about cash flow management” with its clients, but that, overall, the creditworthiness of its variable-rate customers is higher compared to their fixed-rate counterparts. Variable mortgage customers maintain approximately 36% higher balances in their deposit accounts compared to fixed-rate customers, the bank noted.

“As we look at the liquidity position of checking and savings accounts combined in the variable customer balances that are with us, we see well over a year’s worth of excess liquidity to absorb payment increases of $200, $300, $400 per month,” Rees said. “So, we’re not concerned about the credit side of the mortgage position…[and] from a consumer behaviour standpoint, the variable customer is in good shape.”

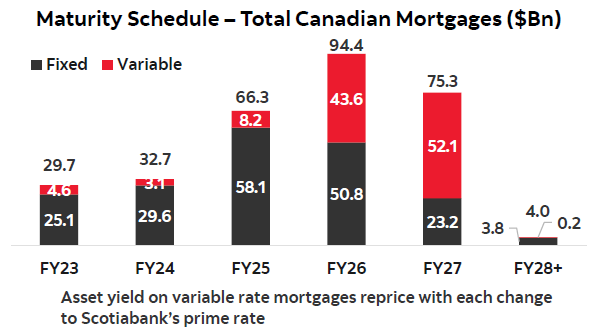

Scotiabank also provided insight into the maturity schedule for its mortgage portfolio, showing that the bulk of loans ($94.4 billion) will be up for renewal in 2026.

“Despite higher interest rates and inflation, our customers’ financial health remains resilient,” said Chief Risk Officer Phil Thomas. “Canadian retail deposits, on average, are 13% higher than they were in February 2020. And delinquency of 90-plus days for Canadian retail has been stable at 15 basis points for the last three quarters and roughly half of the pre-pandemic ratio.”

Scotiabank earnings highlights

Q4 net income: $2.09 billion (-20% Y/Y)

Earnings per share: $1.63

- The total portfolio of residential retail mortgages rose to $302 billion in Q4, up from $280 billion a year ago.

- 28% of the bank’s residential mortgage portfolio is insured. Of the uninsured balances, the average loan-to-value of this portfolio is 49%.

- Residential mortgage volume was up 11% year-over-year.

- Net interest margin in Q4 was 2.26%, down from 2.29% in Q3 but up from 2.20% a year ago.

- Mortgage loans that were 90+ days past due held steady at 0.09%, unchanged from the previous quarter but down from 0.12% in Q4 2021.

- Scotia raised its provisions for credit losses to $529 million in the quarter, up from $412 million in Q3 and $168 million a year ago.

Source: Scotiabank Q4 Investor Presentation

Conference Call

- “Strategically, we’ve been focused in the mortgage business at cross-selling into the deposits,” said Dan Rees, head of Canadian Banking. “We’ve been doing that year-on-year now for the last three years. 50% of our mortgage holders have a deposit account with us. And within the first six months of opening a variable-rate mortgage, [our] customers now have three or more products.”

- “I think our emphasis on deposits may well have been overshadowed in the front half of the year where we saw strong mortgage growth,” said Rees. “Clearly, in the last two quarters, you’ve seen deposit growth rates in Canadian Banking equal or beat loan growth rates; and in Q4 in balances, deposits grew faster than loans. So, that emphasis on a balanced balance sheet will continue in ’23, and that should help NIM.”

- “The bank’s earnings in 2023 are expected to benefit from higher interest income and non-interest revenue, but be impacted by higher funding costs, higher expenses, normalizing provisions for credit losses…and a higher tax rate in both Canada and certain international countries,” said Raj Viswanathan, Chief Financial Officer.

Featured image by Pavlo Gonchar/SOPA Images/LightRocket via Getty Images

Note: Transcripts are provided as-is from the companies and/or third-party sources, and their accuracy cannot be 100% ass

Variable rate mortgages where the pay can change monthly is hardly comforting. Wow. Where is the Scotiaban getting their ideas? If I didn’t know how much my mortgage payment would increase each month it would be very, very concerning.